A Contradiction between Matter and Form:

On the Significance of the Production of Relative Surplus Value in the Dynamic of Terminal Crisis (2008)

While mainstream economics is under the belief that it addresses only the material side of capitalist production, and is interested in variables such as the “real” growth of GDP or “real” income — figures that are in fact themselves mediated through monetary values — most work in economics subscribing to the labor theory of value regards itself as investigating the very same “material” process of production, only here with reference to the quantities of value and surplus value realized in its products. Both sides would appear to hold to the tacit assumption that it is a question here merely of different units of measurement of wealth as such.

Against this trend, the present work, following Marx, takes as its starting point a historically specific, dual concept of wealth within capitalism, as represented by the dual character of the commodity and of labor. As the dominant form (Form) of wealth in capitalism, the commodity stands opposite material wealth. And while the particular form or shape (Gestalt) assumed by such material wealth is irrelevant for capital, as the bearer of value it remains indispensable. However, as productivity increases, these two forms of wealth necessarily begin to diverge, and do so in a way that allowed Marx to speak of capital as “moving contradiction.” It is this contradiction that is to be investigated in this essay.

In carrying out this investigation, my aim is to assess — against the background of the more serious counterarguments since formulated against it — the argument advanced by Robert Kurz in “The Crisis of Exchange Value” (see this volume), first published twenty-seven years ago (1986) and the foundation of crisis theory in the former, pre-2005 Krisis.1 According to Kurz’s argument, capital is heading for a terminal crisis because increasing productivity means that in the long term the total social (or global) production of surplus value can only decrease, and that the valorization of capital must ultimately grind to a halt.

With respect to this diagnosis the present work does not fundamentally differ from Kurz, but it justifies it from a somewhat different angle, with reference here to the representation of the mass of surplus value at the level of society as a whole. On one hand, this mass can be determined, as with Kurz (“Crisis of Exchange Value” and “Die Himmelfahrt des Geldes”) by starting from the surplus value created by the individual worker which, when multiplied by the total number of such individuals, gives us the total surplus value created by all productive workers; but it can also be determined, as it is here, by starting from the surplus value realized in a single material unit of production which, when multiplied here by the total number of such units, results in the total surplus value realized in material production.2 These two modes of presentation do not contradict one another, yet they do allow different aspects of the same process to come into view.

In addition, the approach chosen here makes it possible to relate the dynamics of terminal crisis to capital’s tendency, analyzed by Moishe Postone, toward environmental destruction.3

This present work contains a small core section in which the analysis is represented in mathematical terms. Anyone who cannot stand formulae should skip over them. Of greatest importance for understanding what follows are three tables and a single graph, the qualitative meaning of which can, however, also be grasped without recourse to formulae.

The Terminal Crisis of Capital? A Controversy

The crisis theory of the original (pre-2005) Krisis met with numerous objections and criticisms that need not be taken seriously here insofar as they merely follow their own, well-trodden paths and do not even begin to take any real cognizance of the reasoning contained in that theory. These include the dogmatic notion that since capitalism has on each occasion raised itself from its own crises like a phoenix from the ashes, it will therefore continue to do so. Not even modern positivism dares advance such a crude inductionism. Other conceptions deny the objective side of the dynamic of capitalism altogether, and emphasize that capitalism could only be overcome by a revolution or even a “voluntaristic act.” This is correct insofar as the transition to a liberated society of whatever kind presupposes conscious human action. But it does not follow from this that in the absence of such a transition capitalism can continue to function without a care: it could also end in horror.

The diagnosis that draws attention to this, first put forward by Kurz in “The Crisis of Exchange Value,” argues — to summarize it in broad strokes — that capital, through the compulsive increase in productivity induced by the market, digs its own grave, because it increasingly removes labor, and thus its own substance, from the surplus-value-creating process of production. In this context an exceptional role is played by “science as productive force” in general, and the “microelectronic revolution” in particular. The text can be read as a development and actualization of a well-known Marxian observation from the fragment on machines found in the Grundrisse: “Capital itself is the moving contradiction, [in] that it presses to reduce labor time to a minimum, while it posits labor time, on the other side, as sole measure and source of wealth.”4

In that same passage in the Grundrisse, Marx remarks that this contradiction is adequate to blow the blinkered foundation of the capitalist mode of production sky-high.

Among the critics of the thesis of an inevitable, terminal crisis of capital, Michael Heinrich plays an exceptional role insofar as, at least in part, he directly engages this thesis on the level of its logical development. Since he will not hear of any tendency of capital toward collapse, he must argue against the Marx of the Grundrisse and does so by playing off the latter against the Marx of Capital.5 Thus Heinrich:

The value aspect of the process [of terminal capitalist crisis], which holds that less and less labor must be expended in the process of production of the individual commodities, is analyzed in Capital not as a tendency toward collapse, but as the foundation of the production of relative surplus value. The apparent contradiction that so astonished Marx, that capital “presses to reduce labor time to a minimum, while it posits labor time, on the other side, as sole measure and source of wealth,” even becomes for Kurz, Trenkle and other representatives of the Krisis group “capital’s logical self-contradiction,” of which capitalism must necessarily perish. In the first volume of Capital, in contrast, Marx decodes this contradiction in passing as an old riddle of political economy with which the French economist Quesnay had already tortured his opponents in the eighteenth century. This riddle, Marx argues, is easy to understand as long as one takes into consideration that what is important for the capitalist is not the absolute value of the commodity, but the surplus value (or profit) that this commodity brings him. The labor time necessary for the production of the individual commodity can by all means fall, the value of the commodity can decrease, as long as the surplus value or profit produced by his capital grows.6

In the first instance it must be noted that Heinrich here evidently conflates two distinct levels between which a contradiction can arise: Marx does in fact decode a riddle that appeared to the economists as a logical contradiction and was indeed a defect in their theory. But such a decoding does not of course do away with the “moving contradiction,” situated as it is on the real and not just the logical plane; at most it has the potential for explaining the contradiction even as it is left undisturbed. This contradiction consists, for the Marx of the Grundrisse, in the fact that capital, in its unconscious internal dynamic, seals up the well from which it draws its life. Against this, Heinrich points to Marx’s argument in Capital that the progressive increase in productivity is what grounds the possibility of generating relative surplus value, as if this progression were not itself compatible with a tendency toward collapse. Is this the case? Does there exist an incompatibility between the production of relative surplus value and capital’s tendency toward its own destruction?

Kurz, in contrast, declares that

capital itself becomes the absolute logical and historical limit in the production of relative surplus value. Capital has no interest and cannot be interested in the absolute creation of value; it is fixated only on surplus value in the forms in which it appears at the surface, that is to say on the relative proportion within the newly created value of the value of labor power (the costs of its reproduction) to the share of the new value that is appropriated by capital. As soon as capital can no longer go on expanding the creation of value in absolute terms by extending the working day, but can only increase the relative size of its own share of the newly created value by means of the development of productivity, there arises in the production of relative surplus value a countermovement, which must consume itself historically and work towards and bring about a standstill in the process of value creation. With the development of productivity, capital increases the extent of exploitation, but in doing so it undermines the foundation and the object of exploitation, the production of value as such. For the production of relative surplus value, inseparable as it is from the progressive fusion of modern science with the material process of production, includes the tendency toward the elimination of living, immediate, productive labor, as the only source of total social value creation.7

Here it is not only the case that the production of relative surplus value is in no way in contradiction with capital’s tendency toward collapse: it is also, conversely, in fact the very tool by means of which capital itself becomes its own “absolute logical and historical limit.” But in that case the Marx of Capital would not have corrected the Marx of the Grundrisse at all, as Heinrich claims, but only given a more precise justification for the “moving contradiction.”

Evidently (and not entirely surprisingly) what is at stake here is a controversy. It is possible to get to the bottom of it because the opposing parties have a common point of departure, namely the category, introduced by Marx into the critique of political economy, of “relative surplus value” — from which, however, many completely different and even mutually contradictory conclusions can be drawn. The following attempt at a contribution to clarification must therefore return afresh to this shared point of departure. The debate, often mentioned in the context of debates over crisis theory, between Norbert Trenkle and Heinrich is not suitable as a reference for this purpose, because Trenkle’s view that a final crisis is approaching does not entail an account of surplus value.8

Productivity, Value, and Material Wealth

We speak of an increase in productivity when in a given labor time a greater material output, or — and this is the same thing — when a given quantity of commodities can be produced with lower expenditure of labor, thus decreasing their value. Productivity is thus the proportional relationship of the material quantity of commodities to the labor time necessary for their production. In order to understand productivity and the change it undergoes, it is therefore urgently necessary to distinguish between magnitude of value and material wealth.

When Marx speaks of how capital (see above) “posits labor time [...] as sole measure and source of wealth,” what is at stake is wealth expressed in the value form. For the Marx of the Grundrisse, this historically specific form of wealth, only valid in capitalist society and characterizing its “very heart,” increasingly comes into opposition with “real wealth.”9

But to the degree that large industry develops, the creation of real wealth comes to depend less on labor time and on the amount of labor employed than on the power of the agencies set in motion during labor time, whose “powerful effectiveness” is itself in turn out of all proportion to the direct labor time spent on their production, depending rather on the general state of science and on the progress of technology, or the application of this science to production.10

In Capital Marx speaks not of “real” but of “material wealth,” which is formed of use values. This term is more appropriate for the reason that even material wealth in developed capitalist society is not the same as in noncapitalist societies: rather, the configurations in which it appears are themselves shaped by wealth in the value form. At this point it is sufficient to register that in capitalist society these two different forms of wealth must be conceptually distinguished from one another. “The wealth of societies in which the capitalist mode of production prevails appears as an ‘immense collection of commodities.’”11 And in the dual character of commodities, the fact that they are bearers both of value and use value, one can see reflected the two different forms of wealth in these societies.

Value is the predominant, nonmaterial form of wealth in capitalism — in this regard the actual character of material wealth in the value form is irrelevant. Capitalist economic activity aims solely at increasing this form of wealth (valorization of value), which finds its expression in money. Economic activity that promises no surplus value cannot continue, no matter how much material wealth it could produce. Why, indeed, should someone cast his capital into the process of production, when at the end of the process he would receive at most just as much value as he had put in?

Material wealth — according to Postone, characteristic of noncapitalist societies as their dominant form of wealth — is measured, in contrast, in use values to which society has direct access and which can serve extremely varied and completely different purposes.12 500 tables, 4,000 pairs of trousers, 200 hectares of land, fourteen lectures on nanotechnology, or even thirty cluster bombs would in this respect all be material wealth. Firstly, material wealth is not necessarily generated by labor, nor is it (as in the case of the air we breathe) necessarily bound to the commodity form, even if it is (as in the case of land) frequently brought into this form. Secondly, material wealth does not necessarily consist just of material goods, but can also comprise knowledge, information, other immaterial goods, and their distribution. Thirdly, it is important to guard against seeing in material wealth what is “good” as such. Although material wealth is not bound to the commodity form, and although labor is not its only source, the commodity nonetheless comprises in capitalism, conversely, the “material bearer” of value, which for its part remains bound to material wealth.13 The aim of commodity production — that is, the accumulation of more and more surplus value — deforms as a matter of course the quality of material wealth, the producers of which are not simultaneously its consumers: the aim can never be that of maximal enjoyment in the use of material wealth, but only that of maximal microeconomic efficiency. It would not therefore be possible to overcome capitalist society if that were to consist merely in the liberation of material wealth from the compulsions of the valorization of capital; it would also, necessarily, involve the overcoming of those deformations of material wealth produced by value itself.

There is nonetheless a difference between the two forms of wealth when they are assessed in a qualitative sense. Under the material aspect, the only matter of importance is the use that can be made of things. From the perspective of wealth in the value form, in contrast, the only matter of importance as to the question of whether I, as entrepreneur, would rather produce 500 tables or thirty cluster bombs is that of the surplus value that I can obtain in each respective case.

In the concept of productivity, an abstraction takes place from the qualitative dimension of material wealth, for which reason I prefer to speak in this context of numbers of material units rather than numbers of use values. This restriction of the field of consideration here to matters of quantity is, this terminological distinction notwithstanding, still fraught with problems, because it is impossible to say whether, for example, more material wealth consists in 500 tables or in 4,000 pairs of pants — because they are qualitatively different, they are not comparable on the material level. A concept of productivity that brings both forms of wealth into relation with one another would therefore require differentiation according to the qualities which material wealth can take on: productivity in the production of tables is, or would be, different from productivity in the production of pants, and so on.

In what follows the focus is on the quantitative relationships between these two forms of wealth, both of which are created in commodity production. And while both forms are fixed in relation to each other at any give point in time, they are also, as Marx observes, in a perpetual state of flux:

In itself, an increase in the quantity of use-values constitutes an increase in material wealth. Two coats will clothe two men, one coat will only clothe one man, etc. Nevertheless, an increase in the amount of material wealth may correspond to a simultaneous fall in the magnitude of its value. By “productivity” of course, we always mean the productivity of concrete useful labour; in reality this determines only the degree of effectiveness of productive activity directed towards a given purpose within a given period of time. Useful labour becomes, therefore, a more or less abundant source of products in direct proportion as its productivity rises or falls. As against this, however, variations in productivity have no impact whatever on the labour itself represented in value. As productivity is an attribute of labour in its concrete useful form, it naturally ceases to have any bearing on that labour as soon as we abstract from its concrete useful form. The same labour, therefore, performed for the same length of time, always yields the same amount of value, independently of any variations in productivity. But it provides different quantities of use-values during equal periods of time; more, if productivity rises; fewer, if it falls. For this reason, the same change in productivity which increases the fruitfulness of labour, and therefore the amount of use-values produced by it, also brings about a reduction in the value of this increased total amount, if it cuts down the total amount of labour-time necessary to produce the use-values. The converse also holds.14

I here draw attention to this distinction between material wealth and wealth in the commodity form, the very basis upon which Capital is able to assume its unique propositional form and centrality to the Marxian critique of political economy, because for us, as subjects in thrall to the commodity fetish and who reproduce ourselves by means of this fetish, it cannot simply be taken as read. In our everyday life, shaped by the commodity form, each of the two forms of wealth appears as “natural” to the same extent as does the other, and indeed usually as identical. This is not only because value requires a material bearer, but also because the acquisition of use values is usually carried out by our buying them — that is, our giving out value in the money form in exchange for use values. In modern everyday life ignoring the distinction between wealth expressed in the value form and material wealth may well be unproblematic, and may well even make everyday actions easier. But any theory that papers over this distinction — or, indeed, that does not acknowledge it in the first place — will necessarily miss the historically specific core of the capitalist mode of production.

This holds — naturally, one could say — for mainstream neoclassical economic theory, for which the ahistorical aim of all economic activity consists in the maximization of individual utility, something that in turn consists in the optimal combination of “packages of goods.” Abstract wealth, meanwhile, serves only as the “veil of money” that conceals the allocation of material wealth, and which therefore needs to be pulled away for the sake of greater clarity, and removed from economic theory.

The same holds for classical political economy. See David Ricardo, for example, when he writes in the preface to his major work:

The produce of the earth — all that is derived from its surface by the united application of labor, machinery, and capital, is divided among three classes of the community; namely, the proprietor of the land, the owner of the stock or capital necessary for its cultivation, and the laborers by whose industry it is cultivated.

But in different stages of society, the proportions of the whole produce of the earth which will be allotted to each of these classes, under the names of rent, profit, and wages, will be essentially different [...]

To determine the laws which regulate this distribution, is the principal problem in Political Economy[.]15

What is under discussion here is merely the distribution of material wealth, while there is no mention of the particular form of wealth in capitalism, which probably does not even come into the author’s consciousness. Traditional Marxism also seems only rarely to have gone beyond this understanding. Labor, which “creates all wealth,” is for traditional Marxism just as much an ahistorical natural given as the wealth which it has created. The kind of critique specific to traditional Marxism, which remains within the sphere of circulation, is only directed against the distribution of wealth as such, but not against the historically specific form of wealth in capitalism. Following Postone, it can be observed that an essential dimension of the Marxian critique of value thus remains obscured:

[M]any arguments regarding Marx’s analysis of the uniqueness of labor as the source of value do not acknowledge his distinction between “real wealth” (or “material wealth”) and value. Marx’s “labor theory of value,” however, is not a theory of the unique properties of labor in general, but is an analysis of the historical specificity of value as a form of wealth, and of the labor that supposedly constitutes it. Consequently, it is irrelevant to Marx’s endeavour to argue for or against this theory of value as if it were intended to be a labor theory of (transhistorical) wealth — that is, as if Marx had written a political economy rather than a critique of political economy.16

Entire mountains of theory have been built up on this misunderstanding, criticized here by Postone, of Marx’s intention. A particularly striking example is provided by Jürgen Habermas, who takes of all sources the often-cited extract from the fragment on machines from the Grundrisse to attribute to Marx a “revisionist notion”:

In the Grundrisse for the Critique of Political Economy a very interesting consideration is to be found, from which it appears that Marx himself once viewed the scientific development of the technical forces of production as a possible source of value. For here Marx limits the presupposition of the labor theory of value, that the “quantum of applied labor is the decisive factor in the production of wealth,” by the following: “But as heavy industry develops the creation of real wealth depends less on labor time and on the quantity of labor utilized than on the power of mechanized agents which are set in motion during the labor time. The powerful effectiveness of these agents, in its turn, bears no relation to the immediate labor time that their labor costs. It depends rather on the general state of science and on technological progress, or the application of this science to production.” [...] Marx, of course, finally dropped this “revisionist” notion: it was not incorporated in his final formulation of the labor theory of value.17

Completely missing Marx’s point, Habermas evidently equates “real” wealth with wealth in the value form. For this is the only way in which he can imply that Marx “viewed the scientific development of the technical forces of production as a possible source of value.” In doing so he deliberately overlooks the fact that in this context, a page later in the fragment on machines, Marx — as cited — speaks of capital as a “moving contradiction,” which is more or less the opposite of Habermas’s claim of a “revisionist notion.” As Postone demonstrates, this implicit identification of wealth and value, attributed to Marx but subject to no further reflection whatsoever — and thus the ontologization of value and of labor as though they belonged to history only on the unspecified level of the human species — is the fundamental presupposition and thus results in the complete falsification that is Habermas’s critique of Marx and all his attempts to go beyond Marx.18

Even as accomplished a value theorist as Michael Heinrich, who is thoroughly familiar with the distinction between wealth expressed in the value form and material wealth, is not always immune to the equation of these two forms of wealth. To the thesis developed by Kurz that “productive” (surplus-value-producing) labor is melting away and that the proportion of “unproductive” labor, financed by the surplus value produced by total social labor, is continually increasing, and that taken as a whole, the production of surplus value that is available to capital accumulation is sinking,19 Heinrich objects as follows:

increasing productivity ensures that the mass of surplus value produced by “productive” labor power grows steadily, and therefore that “productive” labor power can sustain a continually growing mass of unproductive labor.20

On the level of material wealth, to which alone the growing productivity of labor refers, this argument could of course, on the level of sheer possibility, turn out to be correct, but this fact has nothing to do with the “mass of surplus value produced by productive labor power,” for this mass is measured simply in terms of expended labor time, on account of which the mass of surplus value produced on a single working day by labor power, however productive it is, can never be greater than this one working day.

The same mistake, perhaps borrowed from Heinrich and simply taken to extremes, can be found in the Initiative Sozialistisches Forum (ISF)’s collectively authored pamphlet "Der Theoretiker ist der Wert.”21 Here, again directed against Kurz, the possibility of a “capitalist service society” is postulated:

Let us assume that it is the case that all the “hardware” required by such a society could be produced, because of the immense productivity of labor, with minimal labor time — let us say 100,000 hours of labor in a given year X. What would prevent here the production of a mass of surplus value which would make it possible in this year X productively to cover all the money that the perhaps 10 billion service providers can save and invest at interest? Money would then concentrate in fewer hands than these 10 billion — let us say 10 million — and can be employed partly as speculative capital, but partly also as capital in competition with the producers of surplus value who work for 100,000 hours — in order in this way to secure power of disposal over society. This power of disposal over society is also a matter of importance — for in the end we still live in a class society, if also in one in which the classes, as Adorno says, have evaporated into a “super-empirical concept.” The power relations in a society that is constructed in such a way still depend on — and in this society depend all the more on — the power of disposal over this “hardware”-producing labor.22

The question of whether or not such a society would be possible I will for the moment leave unadressed, but it is certain that there is one thing that such a society would not be, because of the impossibility of the valorization of capital, and that is capitalist. The ten million hands in which the capital would be concentrated would be allowed to exploit 100,000 working hours per year: each one, that is, one-hundredth of an hour, that is to say thirty-six seconds — nothing in comparison with a working day of perhaps eight hours, multiplied by 200 working days per year and ten billion “hands” that are fit to work. Under these conditions, why should even one of the ten million owners of capital cast his good money into the process of production? Here too, the mistake lies in the equation of the two forms of wealth: it is indeed imaginable that one day 100,000 hours of labor time per year would be sufficient to meet the needs of a population of ten billion people. But for want of a sufficient mass of surplus value, it simply will no longer pass through the eye of the needle of valorization.

It is in no way a coincidence that mistakes of this sort — made by people who should really know better — come to the surface at precisely the time when polemics are being directed at the possibility of a final crisis of capital. For the diagnosis of the necessary emergence of such a crisis essentially depends — as will presently be made clear — on the distinction between the two forms of wealth mentioned, and in the fact that they increasingly diverge from one another.

The Production of Relative Surplus Value

Marx defines as relative surplus value the surplus value that emerges as a result of the process in which, by means of the increase in the productivity of labor, and therefore the reduction in price of labor power, the necessary labor time can be shortened and the surplus labor time correspondingly increased, without lowering the real wage or lengthening the working day, as would be the case in the production of absolute surplus value.23 The production of relative surplus value is the form of production of surplus value appropriate to developed capitalism, and is bound up with the real subsumption of labor under capital.24

This tendency for the productivity of labor to increase is one of the immanent laws of the capitalist mode of production, since each individual business that succeeds in raising the productivity of its own labor powers beyond the current average by the introduction of a new technology can sell its commodities for a higher profit. The consequence of this is that the new technology is universalized under the compulsive law of competition, the higher profit disappears again, and the commodity in question becomes cheaper. If this commodity belongs for its part to the supplies necessary for the reproduction of labor power — that is to say, if it is a determinant aspect of the value of labor power — its reduction in price also leads to a reduction in the price of labor power.

With the further uniform development of productivity now becoming general for all commodities (and leading to their reduction in price, including the price of the labor-power commodity itself), the necessary labor time always decreases. Yet this does not result in a reduction in the working day, but rather in a lengthening of the surplus labor time, and thus an increase in the surplus value produced on any given working day:

Now, since relative surplus-value increases in direct proportion to the productivity of labor, while the value of commodities stands in precisely the opposite relation to the growth of productivity; since the same process both cheapens commodities and augments the surplus-value contained in them, we have here the solution to the following riddle: Why does the capitalist, whose sole concern is to produce exchange-value, continually strive to bring down the exchange-value of commodities? One of the founders of political economy, Quesnay, used to torment his opponents with this question, and they could find no answer to it.25

This statement by Marx, to which Heinrich (see above) also appeals, requires clarification. It is immediately obvious that the rate of surplus value and thus the proportion of surplus value in the value of a commodity increases with the productivity of labor. But the statement can also be read (and is read) as if it says that the surplus value contained within a commodity grows, although its value falls. Is this possible? And if so, is it true in the long term? It sounds at the very least improbable.

|

value of the commodity (social average) s+v |

necessary (paid) labor v |

surplus value (surplus labor) s |

rate of surplus value s'=s/v |

||

|

1 |

old technology |

1,000 |

800 |

200 |

0.25 |

|

2 |

new technology in the individual enterprise (including extra profit) |

1,000 |

640 |

360 |

0.5625 |

|

3 |

new technology across the sector (without reduction in price of labor-power) |

800 |

640 |

160 |

0.25 |

|

4 |

general increase in productivity (with reduction in price of labor power) |

800 |

512 |

288 |

0.5625 |

Table 1: Production of Relative Surplus Value at Low Rate

Table 1 shows a numerical example of the production of relative surplus value. It refers to a single commodity, a fixed number of material units (500 tables, 4,000 pairs of pants, or one automobile), or to a “shopping basket,” an arbitrary combination of such units. The numbers represent labor time (expressed approximately in working days), by which is meant the labor time that goes into the product (including the production of the raw materials, machinery, and so on, that it requires). What is described here is the effect of a technological innovation that reduces the labor time required for production by twenty percent, which is equivalent to an increase in productivity of twenty-five percent. In a working day, 125 percent of the previous quantity is produced.

With the old technology (row 1), 1,000 working days are necessary, divided into 800 working days that are necessary for the reproduction of labor power, and 200 working days that serve for the production of surplus value. A new technology is now developed in a single business (row 2), allowing the labor time required to be reduced by twenty percent, that is reduced to 640 working days. The company introduces this technology because it enables profit to be increased, and allows an advantage in innovation to be attained. As long as this technology has not been established across the entire sector, the value of the commodity remains unaffected by it, because socially average production still proceeds according to the old technology. Although the individual business can now produce the commodity twenty percent more cheaply, it can sell it at the previous price. Although only 640 days of paid labor are now employed in its production, it is still worth 1,000 working days. The individual business thus realizes an extra profit, even when it sells its commodity somewhat more cheaply than its competition in order to increase its market share.26

Under the compulsive laws of capitalist competition, the new technology becomes established in the entire sector (row 3) of production for the commodity in question: businesses that continued to use the old technology would become unprofitable and be driven out of the market. At the end of such a process of displacement and readjustment, all production would involve the new technology, which now corresponds to the social average. But with this the value of the commodity sinks by twenty percent, and the extra profit disappears again: compared with the previous situation, the surplus value contained in the material unit has fallen by twenty percent.

Forceably brought about by competition between individual capitals and between regional and even national economies, this counterproductive effect on the valorization of capital can be compensated for if the increase in productivity also obtains for the commodities necessary for the reproduction of labor power: if we assume an across-the-board decrease of twenty percent in the labor time necessary for commodity production (row 4), the commodity labor power also becomes cheaper by the same proportion. If wages remain constant in real terms, only 512 instead of the previous 640 working days are necessary for the reproduction of labor power, and there remain 288 working days for the production of surplus value.

The production of relative surplus value increases the rate of surplus value in every case, and in the numerical sample in Table 1 it also increases the mass of surplus value contained in a material unit, although their total value (in rows 3 and 4) decreases. There thus remains a margin for increasing wages in real terms, both in the individual business of row 2 and after the general increase in productivity in row 4, as has certainly been the case in the history of capital, which, in combination with the reduction in price of commodities, meant that both new innovations and what had previously been luxury goods became available for mass consumption for the first time. So, love, peace, and harmony?

|

value of the commodity (social average) s+v |

necessary (paid) labor v |

surplus value (surplus labor) s |

rate of surplus value s'=s/v |

||

|

1 |

old technology |

1,000 |

400 |

600 |

1.5 |

|

2 |

new technology in the individual enterprise (including extra profit) |

1,000 |

320 |

680 |

2.125 |

|

3 |

new technology across the sector (without reduction in price of labor-power) |

800 |

320 |

480 |

1.5 |

|

4 |

general increase in productivity (with reduction in price of labor power) |

800 |

256 |

544 |

2.125 |

Table 2: Production of Relative Surplus Value at Higher Rate

Table 2 demonstrates that argumentation via numerical examples is risky, because it is impossible to generalize from such examples without doing further work. The same calculations were carried out here as in Table 1, but on the basis of a different division into necessary and surplus labor time and with a rate of surplus value of 1.5 already before the start of a process of innovation. Here too, as a result of the decrease in the labor time required for the production of the material unit, the rate of surplus value climbs starkly, but the bottom line is that the mass of surplus value contained in the commodities produced falls from 600 to 544 working days. The reason for this consists in the fact that the compensatory effect on the general decrease in the magnitude of value brought about by the simultaneous reduction in the price of labor power is only slight, because the proportion of paid labor in the value of the commodity is already low in the first place. If wages remain constant in real terms, an increase in productivity always leads to an increase in the rate of surplus value and a decrease in the value of the commodity. Against this, the mass of surplus value realized in the material unit is subject to two opposing influences: on one hand, as a fraction of the total value of the commodity, it falls in proportion to the fall in this value; on the other hand, it grows to the extent that the amount of surplus value in proportion to the total value of the commodity grows, because of the reduction in the price of labor power. What ultimately results depends on the magnitude of the proportion of paid labor at the start of the process of innovation, for it is only at the expense of this labor that the mass of surplus value can rise. So, if the rate of surplus value is low, the proportion of necessary labor correspondingly high, the mass of surplus value in the material unit increases; in contrast, if the rate of surplus value is high, and the proportion of paid labor in the total value therefore low, the mass of surplus value decreases. Since, on the basis of only two numerical examples, this assertion is still left up in the air, a more general observation is necessary, independent of the particular numerical values. This is also an opportunity to clarify where the boundary between “low” and “high” rates of surplus value lies.

|

value of the commodity (social average) s+v |

necessary (paid) labor v |

surplus value (surplus labor) s |

rate of surplus value s'=s/v |

||

|

1 |

old technology |

s1+v1 |

v1 |

s1 |

s1'=s1/v1 |

|

2 |

new technology in the individual enterprise (including extra profit) |

s1+v1 |

v1/p |

s1+v1-v1/p |

s1'p+p-1 |

|

3 |

new technology across the sector (without reduction in price of labor-power) |

(s1+v1)/p |

v1/p |

s1/p |

s1' |

|

4 |

general increase in productivity (with reduction in price of labor power) |

(s1+v1)/p |

v1/p2 |

((s1+v1)/p-v1)/p2 |

s1'p+p-1 |

Table 3: Production of Relative Surplus Value in General

In Table 3, the same calculation was carried out in a more general form, where v1 and s1 are the starting values for the necessary and surplus labor, and p is the factor by which the productivity increases with the introduction of the new technology in comparison with the old (in Tables 1 and 2, p was defined as 1.25). The production of relative surplus value functions by means of the fact that with a general increase in productivity by factor p (final row), the total commodity value is divided by this same factor, but the value of the necessary labor is divided by the factor p2, because both the labor time necessary for commodity production and the reproduction costs of the single working day have decreased by the factor 1/p. The formulae for s and s' in the last row are of interest for the effect of an increase in productivity on the surplus value contained in a given material quantity:

![]()

Expressing p in terms of s' with the help of the second formula:

![]()

and if this expression is included in the formula for s, the result is

![]()

Because s1 = v1 s1', the numerators of both fractions agree, and one gets

![]()

The constant

![]()

can be interpreted as the labor time which can be reproduced by means of the given quantity of material wealth. It is constant because wages are here assumed to be constant in real terms. For the total value

![]()

r results precisely in the (fictitious, precapitalist) situation in which the total amount produced must be used for the reproduction of labor power, in which it is therefore impossible to extract surplus value at all.

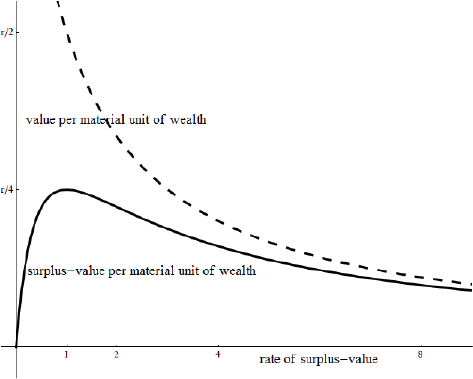

The relationship developed here between the rate of surplus value and the amount of surplus value per unit of material wealth is presented graphically in Graph 1. The graph should not be interpreted any more than the formulae that underpin it as saying that the rate of surplus value is the independent variable, and consequently the mass of surplus value is the dependent variable. Rather, the magnitudes expressed in both variables depend on productivity: the rate of surplus value increases in direct proportion to productivity, and as long as the rate of surplus value remains below 1, the mass of surplus value also grows. It reaches its maximum when the rate of surplus value reaches 1. But with further increases in productivity and in the rate of surplus value, the surplus value falls again, and, with unlimited growth in productivity, tends, like the total value, toward zero.

Graph 1: Rate of surplus value and (surplus) value per material unit

The relationships displayed here are not of an empirical nature: they reveal rather the logic of the production of relative surplus value in its pure form — under the assumption, that is, that the length of the working day remains constant, as do wages, in real terms, and that the change in productivity takes place uniformly in all sectors and for all products. In capitalism’s immediate reality, this is of course not the case. Wages and working hours are always changing as a consequence of social struggles, and upward surges in productivity take place in an entirely asynchronous manner and to an extent that differs across different sectors.27

Moreover, the products themselves are always changing, and new products are always emerging, while others disappear. It is beyond doubt, for example, that productivity in the automobile industry has increased drastically in the last fifty years, but in order to quantify this increase precisely it would be necessary to find a new car that is comparatively the same as the 1950s Volkswagen Beetle — and no such car now exists. And it would not be possible to compare the production of CD players over thirty years, because thirty years ago there were no CD players, and so on.

To this extent, the calculation carried out here, along with its result as presented in Graph 1, describes nothing more than a developmental tendency, which could perhaps have been made clear without such calculation. But nevertheless, this developmental tendency really exists. It is grounded in what Marx describes as the compulsion, ceaselessly operating and induced by market competition, to reduce labor time — that is, to increase productivity. This is something that can be observed, even empirically, across all sectors and products. It is also necessarily the case that if there is unlimited growth in productivity and the value of an individual product slowly but surely disappears, the mass of surplus value realized within a unit of material wealth tends toward zero. Ultimately the mass of surplus value can never be greater than the mass of value. On the other hand it is clear that as long as productivity is no more than is sufficient for the reproduction of labor power (s = 0), no surplus value can be obtained (and, therefore, no capitalism is possible). It is therefore plausible even without the mathematically modeled calculation that the mass of surplus value contained in the individual product (and materialized exclusively within such products as use values or units of material wealth) has its maximum somewhere between these two values.

It is necessary to refer to this in two further ways. Firstly, the schema of Tables 1-3, with the result shown in Graph 1, is applicable not only to individual products, but also to arbitrary “shopping baskets” or even to entire national economies, such as in the case of the material wealth produced within a year — the developmental tendency derived from them is therefore of the most general kind. Secondly, the form of production of surplus value by means of perpetual growth in productivity, according to Marx the form appropriate to developed capitalism, cannot simply be switched off, even if it is the case that in the long term it works against its own “interests” insofar as it perpetually reduces the surplus value per unit of material wealth. The dynamic described here is set in motion (see transition to the second step in Tables 1-2) by competition, whether between individual businesses or between states or indeed between any “local site” that can be forced into competition with any or all others. Here the participants act entirely in accordance with their own interests, and have to do so, simply for the sake of their continued existence within capitalism. The dynamic that this sets in motion is therefore indelibly inscribed in the fact that social wealth takes on the value form. It could only be slowed down or even switched off by the abolition of value.

The Developmental Tendency of Relative Surplus Value

Because of the permanently functioning compulsion to reduce labor time it is legitimate to assume that over the course of capitalist development, productivity has always increased, even if not evenly, but in phases marked by bursts of productivity alternating with phases of only slow growth in productivity. But this means that the development, depicted in Graph 1, of the surplus value realized within a material unit as a result of growth in productivity, is also a development in the historical time of capitalism: although each increase in productivity initially led to an increase in the mass of surplus value realized in the individual commodity, in its later phases it leads to a reduction. In this sense, the history of capitalism can be divided into a phase of the rise of relative surplus value, and a phase of its fall.

Capitalism moves in a single unambiguous direction — namely, toward ever-higher productivity over the course of time. This observation is already enough to wrench the ground from underneath all conceptions that hold capitalism to be merely a process of alternation, itself unchanging, between crises and surges of accumulation — proof, as a result of its own internal dynamic, against the possibility that it could one day come to an end. Those very same investments in the streamlining and rationalization of production so widely publicized in recent years — investments intended, for example, to eliminate jobs while production output remains at the same level, to raise the productivity of the remaining job categories and increase the profitability of the individual business enterprise — would, during the phase of increasing relative surplus value, have resulted in the growth of surplus value overall. But in the phase of declining relative surplus value production, higher productivity leads to the reduced production of surplus value overall, with life-threatening consequences for sellers of labor power who have become redundant but also with exacerbating effects on crisis conditions themselves.

Situating in precise historical terms the phase marked by the rise of relative surplus value and the phase marked by its decline, much less the tipping point between the two (at which s' = 1) is, to be sure, impossible — not least because of the possibility of historical discrepancies between the two. However, even without more precise historical-empirical investigations, it can be inferred that in the initial phases of the production of relative surplus value by means of cooperation and by means of the division of labor and manufacture, productivity was so low that there remained, as it were, headroom for the growth in the surplus value of each individual commodity.28 This is perhaps too speculative, but if so it is also of no significance with respect to the question of the final crisis, for which only the late phase of capitalism plays a role, and it is clear that today we have left the tipping point where s' = 1 far behind us: in 2004, the net share of national income accounted for by wages in Germany was about forty percent, which corresponds to a rate of surplus value of 1.5. Here it must also be taken into account that what is important are the net wages not only of the productive (surplus-value-producing) labor powers, but also of the unproductive ones (those paid from the mass of surplus value produced by society as a whole). At this point I do not wish to attempt to provide a more precise distinction between productive and unproductive labor.29 However, within the framework of the critique of political economy it is not disputed that all labors that involve the mere channelling of streams of money (trade, banking, insurance, but also many individual departments of business that otherwise produce surplus value) are unproductive, that is that they produce no surplus value.30 However, this means that the net share of national income accounted for by wages must in fact be considerably lower than the forty percent mentioned, and the rate of surplus value must correspondingly be higher than 1.5.31

For a few decades it has already been possible to observe that capital is increasingly resorting to the production of absolute surplus value — that is, it is attempting to increase surplus value by means of the extension of the working day and by real-terms reductions in wages. This does not of course lead to the disappearance of the perpetual compulsion to increase productivity: it is impossible, therefore, to talk of relative surplus value being superseded once again by absolute surplus value — there is not sufficient opportunity to increase productivity in this way simply because of the natural limitations to the working day, the extension of which can in addition, under today’s conditions, only lead to a reduction in jobs and not to more labor. Similarly, real-terms reductions in wages have a natural limit — zero — and if they approach zero it means nothing other than that the reproduction of labor power must be financed by the state, and therefore by the mass of surplus value produced by society as a whole.

According to Marx, the production of absolute surplus value belongs to an earlier form of the capitalist mode of production, in which labor was only formally subsumed under capital — that is to say, labor power was working for a capitalist, but on the material level the concrete labor was not yet bound to capital. The production of relative surplus value, in contrast, presupposes the real subsumption of labor under capital, which itself now defines the technical process of concrete labor in which labor power is employed.32 If capital is today resorting once again to the production of absolute surplus value, this in no way means that the real subsumption of labor under capital has been suspended, but rather that what is happening is a reaction — in the long term unsuccessful — to the demise of the production of relative surplus value, a demise which, as has been shown, is final and irreversible. Against this background, it is inadequate to conclude, as Heinrich does, that capitalism is returning from the “already almost idyllic conditions” of Fordism to its “normal mode of function,” by which he appears to mean the pre-Fordist phase.33 This ignores the question of what had since happened to productivity, and in this respect simply equates qualitatively distinct phases of the development of capitalism. It is at best an argument based on forms of appearance, and it is indeed entirely possible to compare on this level the relationships of exploitation in present-day China with those of western European capitalism of the nineteenth century. However, the deep currents of the capitalist dynamic remain closed off to such a mode of observation.

It is not clear to me whether Marx took his own analysis of relative surplus value beyond the tipping point that has been identified here, as a result of which he would for the first time have been able to establish the link between the above analysis and his characterization of capital as a “moving contradiction” in the Grundrisse. In the corresponding chapter of Capital I, his argument proceeds exclusively by means of numerical examples of the sort contained in Table 1, that is to say with a low rate of surplus value (e.g., a twelve-hour working day with ten hours of necessary labor and two hours of surplus labor).34 Heinrich appears to see the developmental tendency of relative surplus value, but because of the numerical examples he has chosen, he cannot express the this tendency in terms of its results; or, where he does get as far as to be able to point to these results, he finds ways to fend them off:

The labor time necessary for the production of an individual commodity can certainly sink, the value of the commodity decrease, but only as long as the surplus value or profit produced by its capital increases. Whether the surplus value/profit is distributed among a smaller number of high-value products or a greater number of low-value products is in this case irrelevant.35

The final sentence, which at this point serves to allow Heinrich to take up a position against the Marx of the Grundrisse and the crisis theory of the pre-2005 Krisis, is, however, at the very least extremely risky. Its consequence is that Volkswagen need not care whether, in order to realize the same surplus-value/profit, they must produce and sell four million or fifteen million cars per year. Here it is possible, particularly in markets already saturated, for a problem to arise with respect to turnover, resulting in destructive competition, as has in fact been taking place on the automobile market for years. Heinrich is certainly right in claiming that one can only speak of the surplus value produced by capital as a result of the multiplication of the surplus values of the individual commodity within the material scope of production. On one hand, this means that it is not possible to derive phases within the rise or fall of capital from those within the rise or fall of surplus value. However, on the other hand, it is precisely at this point that the contradiction — also fundamental to the argument advanced by Kurz — between material wealth and the form of value within which such wealth must be subsumed arises a “moving contradiction” that becomes greater with increased production of relative surplus value: the higher productivity, the lower the surplus value contained in the individual commodity, the greater the material output necessary for the constant production of surplus value, the more fierce the competition, the greater the compulsion to further increases in productivity, and so on.

There appears here without doubt an “absolute logical and historical limit” of capital, and the end of its capacity for accumulation thus comes into view.36 Even if the course to be taken by the dynamics of the foreseeable crisis cannot be determined on the level of abstraction that has been taken up here, I shall nonetheless conclude by considering — including with reference to the ecological question — the in no way unambiguous directions in which the contradiction identified here between matter and form can resolve, more or less violently.

The Inner Compulsion Toward Growth, the Historical Expansion of Capital, and the Material Limits Thereof

In a society oriented solely toward material wealth — a society that merely by virtue of that fact would not be capitalist — growth in productivity would only cause a few problems, which could easily be solved technically and could unburden human life, leading to a reduction of labor but nonetheless to an increase in the number of useful goods. This is also precisely the way that the blessings of growing productivity become public knowledge, as the potential for the technical solutions to virtually all human problems. But of course such ideals, constrained within the unquestioned framework of a capitalist mode of production, would imply the belief in a capitalism that could somehow coexist with a constantly shrinking mass of surplus value.37 This, of course, capitalism cannot do.

“When value is the form of wealth, the goal of production is necessarily surplus value. That is, the goal of capitalist production is not simply value but the constant expansion of surplus value.”38 The reason for this is the fact that in the capitalist process of production, self-valorizing capital must reproduce itself “on a progressively increasing scale,” and therefore also “produce” a surplus value that is constantly growing, by incorporating and exploiting a correspondingly growing number of labor powers.39

As productivity increases, this compulsion to growth increases exponentially once again on the material level: if the production of more and more material wealth becomes necessary for the realization of the same surplus value, capital’s material output must accordingly grow even more rapidly than the mass of surplus value. As we have seen, this holds for the phase of the fall of the production of surplus value, a phase that was reached some time ago. Now, if this movement of expansion comes up against limits, because the perpetually growing material wealth must not simply be produced, but also find a buyer, an irreversible crisis dynamic gets underway: a material output that remains constant, or even that increases, but less quickly than productivity, results in permanently shrinking production of surplus value, through which in turn the opportunities for the sale of the material output become fewer, which then has a greater effect on the fall in the mass of surplus value, and so on. It is by no means the case that such a downward movement afflicts all individual capitals uniformly: those affected are in the first instance the less productive, which must disappear from the market, culminating in the collapse of entire national economies such as, for example, in the eastern European countries at the start of the 1990s. The remaining capital can burst into the resulting empty spaces, and for the time being can expand again, which at the surface gives the impression that everything is fine for capital. This may indeed be the case for the survivors in each case — and for the moment — but it changes nothing of the character of the movement as a whole.

The growth of the mass of surplus value and — as long as productivity is increasing — the related and even stronger growth of the material output is the unconscious raison d’etre of capital and the condition sine qua non of the continued existence of the capitalist mode of production. In the past, capital has followed its compulsion to growth — that is, the necessity of its unlimited accumulation — in a process of expansion that is without historical parallel. Kurz names as its essential moments: first, the step-by-step conquering of all branches of production already existing before and independently of capital, and the concomitant condemnation of its working population to wage dependency, which also involves the conquering of geographical space (admired, though with a shudder, in the “Manifesto of the Communist Party” as the compulsion for a “constantly expanding market for its products” that “chases the bourgeoisie across the entire surface of the globe”) and second, the creation of new branches of production for new needs (which themselves have first to be created), bound up, by means of mass consumption, with the additional conquering of the “dissociated,” feminine realm of the reproduction of labor power, and recently the gradual suspension of the division between labor time and leisure time.40

The spaces into which capital has expanded are of material nature, and therefore necessarily finite and at some point, by equal necessity, bound to be full. As concerns the spatial expansionism that is capitalism’s first essential moment (see above), this exhaustion of the planet itself as one, global mass of material for the valorization of capital has without doubt become a fait accompli today: there is now no spot on the earth and no branch of production that has not been delivered up to into the grip of capital. This is in no way altered even by the subsistence production that exists in some places, for this is not the remains of premodernity, but a makeshift means by which those who have fallen out of capitalist production can attempt, after a fashion, to secure their survival.

The question, in contrast, of whether the second moment of the capitalist process of expansion — the generation of new branches of production — has finally reached its end, is unresolved. This moment essentially relied on an expansion of mass consumption — which, however, is only possible if there is a sufficient real-terms rise in wages, which in turn affects the production of relative surplus value. In the high phase of Fordism after World War II — times of full employment — it was for a time even possible to implement trade union demands for wage increases of the magnitude of the growth in productivity. In the schema of wealth presented in Tables 1-3 this means in each case a transition from row 1 to row 3 (and not to row 4), with no change in the rate of surplus value, and a fall in the mass of surplus value per material unit by a factor of 1/p — which for a time could be compensated by the growth in mass consumption. But with perpetual further growth in productivity and the gradual saturation of the markets for the new branches of production (automobiles or household appliances, for example), this process could not be sustained in the long term. Kurz summarizes the situation as it appeared in the mid-1980s as follows:

But both essential forms or moments of the process of capitalist expansion are today starting to come up against absolute material limits. The saturation point of capitalization was reached in the 1960s; this source of the absorption of living labor has come to a final standstill. At the same time, the confluence in microelectronics of natural-scientific technology and the science of labor implies a fundamentally new stage in the revolution of the material labor process. The microelectronic revolution does not eliminate living labor in immediate production only in this or that specific productive technology, but sets out on a wider front, throughout all branches of production, seizing even the unproductive areas. This process has only just started, and will not fully gain traction until the second half of the 1980s; it seems likely that it will continue until the end of the century and beyond. To the extent that new branches of production are created by means of this process, such as in the production of microelectronics itself or in gene technology, they are by their nature from the outset not very labor intensive in respect to immediate production. This brings about the collapse of the historical compensation that has existed up until this point for the absolute immanent limit, embedded within relative surplus value, to the capitalist mode of production. The elimination on a massive scale of living productive labor as a source of the creation of value can no longer be recuperated by newly mass-produced cheap products, since this process of mass production is no longer mediated by a process of reintegrating a labor population that has been made superfluous elsewhere. This brings about a historically irreversible overturning of the relationship between the elimination of living productive labor through scientification on the one hand, and the absorption of living productive labor through processes of capitalization or through the creation of new branches of production on the other: from now on, it is inexorable that more labor is eliminated than can be absorbed. All technological innovations that are to be expected will also tend only in the direction of the further elimination of living labor, all new branches of production will from the outset come to life with less and less direct human productive labor.41

Heinrich describes, somewhat derisively, the direct reference of “Kurz’s theory of collapse” to the “microelectronic revolution” as “technological determinism,” which he claims is wonderfully appropriate “to the ‘workers-movement Marxism’ that is otherwise criticized so very fiercely by Kurz.”42 However, what is at stake here, as Heinrich is certainly aware, is not a particular individual technology, but the fact that technology is making labor to a great extent superfluous — an argument against which Heinrich marshals no argument even in his “more extensive critique.”43 But this ought really to give a theorist of value pause for thought, for a crisis of capital could in that case only fail to result if value and surplus value were not measured in labor time, but natural-scientific technology had instead replaced the application of immediate labor as a source of value, as someone like Habermas believes. But Heinrich does not go this far.

It is correct, on the other hand — and if this had been what Heinrich had said, he would have been right — that a prognosis, based on the here and now, according to which “it is inexorable that more labor is eliminated than can be absorbed,” cannot be derived solely from the category, established on a more abstract level, of relative surplus value. Empirical observations are also required. These exist in great numbers, and Kurz also alludes to them. But empirical semblance can of course deceive, and capital can pull itself together once more — the question is only what the consequences would be for capital and for humanity.

This uncertainty as to the future development of the crisis dynamic changes nothing of the fact that capital must perish as a result of its own dynamic, if it is not overcome by conscious human actions before then. This results simply from the limitless compulsion to growth on one hand, and on the other hand the finitude of the human and material resources on which it depends.

Knut Hüller has already drawn attention to the fact that the total social rate of profit (rate of accumulation) must fall for no other reason than the fact that the labor power available to capital on this earth is simply finite, whereas a constant rate of profit would presuppose an exponentially growing working population.44 And this conclusion was reached without once taking the production of relative surplus value into consideration. If one does so, it becomes clear that constant or even exponentially growing material production leads, if the rate of “real growth” is too low (under the rate of growth of productivity), to an exponential fall in the mass of surplus value (and accordingly to falls in the productively working population).

The observation that “it is inexorable that more labor is eliminated than can be absorbed” is essentially based on the presupposition that capital will no longer be able to compensate for the losses, induced by process innovations, in the production of value and surplus value, by means of product innovations. Much speaks in favor of this claim: even today, twenty-two years later, no innovations of this kind are anywhere to be found. As stated, here it is a matter not of new products and their associated needs as such, but of those whose production requires labor on such a mass scale that it would be possible at least to compensate for the streamlining potential of microelectronics. However, if this prognosis were to reveal itself to be false, the contradiction revealed here between matter and form would in no way be resolved, but would in that case result in a violent discharge in another direction.

The Inner Compulsion Toward Growth and Environmental Destruction

Moreover, all progress in capitalist agriculture is a progress in the art, not only of robbing the worker, but of robbing the soil; all progress in increasing the fertility of the soil for a given time is a progress towards ruining the more long-lasting sources of that fertility. The more a country proceeds from large-scale industry as the background of its development, [...] the more rapid is this process of destruction. [...] Capitalist production, therefore, only develops the techniques and the degree of combination of the social process of production by simultaneously undermining the original sources of all wealth — the soil and the worker.45

Capital requires material wealth as the bearer of value; as such the former is indispensable, and in quantitative terms (see above) it will become even more so. But capital is not concerned with the material wealth that is freely available and that therefore does not become part of the mass of value and surplus value that is produced. In comparison with the necessity of capital accumulation, the preservation of this wealth is at best of lesser importance — or in other words, if the destruction of material wealth serves the valorization of value, then material wealth will be destroyed. It’s that simple. Into this category fall all of its forms which have come into view or been mentioned over the last fifty years in the context of environmental destruction: the long-term fertility of the soil, to which Marx had already referred; air and water of a quality that they can be breathed and drunk without danger to life or limb; biodiversity and undamaged ecosystems, even merely with respect to their function as renewable sources of food; or a climate that is hospitable to human life.

The question is not, therefore, whether the environment is destroyed for the sake of the valorization of value, but at best of the extent of this destruction. And in this matter the growth of productivity, to the extent that it, as the production of relative surplus value, remains bound to value as the predominant form of wealth, plays a thoroughly sinister role because the realization of the same mass of surplus value requires an ever-greater material output and even greater consumption of resources: for the transition from old to new technologies with the purpose of reducing the labor time required is usually achieved by replacing or accelerating human labor with machines. We may assume, for example, in an ideal-typical case, that in the schema of calculation of Tables 1-3 it is possible to make 10,000 shirts in 1,000 working days by the old technology, and this production only requires cloth and labor. The new technology could consist in the reduction of the labor time necessary for the production of the same number of shirts to 500 working days, but to introduce and employ machines and additional energy which for their part could be produced in 300 working days. In the situation described in Table 2, however (s1' > 1), this would mean that in the case of the new, more profitable technique for the realization of the same surplus value as in the old, it would be necessary to produce not only more than 10,000 shirts in a capitalist manner, but also the additional machinery and energy which are used in the process of production. This means that ever-greater consumption of resources becomes necessary for the same surplus value, a consumption that is greater than, and grows even more quickly than, the required material output.

That is, if Kurz was wrong, and the accumulation of capital could continue without restriction, it would sooner or later have as its inevitable consequence the destruction not only of the material foundations of the valorization of capital, but also of human life as such.

Postone draws the following conclusion from his analysis of the contradiction between material wealth and wealth in the value form as it is brought forth by the production of relative surplus value:

Leaving aside considerations of possible limits or barriers to capital accumulation, one consequence implied by this particular dynamic — which yields increases in material wealth far greater than those in surplus value — is the accelerating destruction of the natural environment. According to Marx, as a result of the relationship among productivity, material wealth, and surplus value, the ongoing expansion of the latter increasingly has deleterious consequences for nature as well as for humans.46

In explicit opposition to Horkheimer and Adorno,for whom the domination of nature is itself already the “Fall,” Postone emphasises that “the growing destruction of nature should not simply be seen [...] as a consequence of increasing human control and domination of nature.”47 Such a critique is inadequate because it does not distinguish between value and material wealth, although it is the case that in capitalism nature is exploited and destroyed not because of material wealth, but because of surplus value. The increasing imbalance between the two forms of wealth leads him to come to this conclusion:

The pattern I have outlined suggests that, in the society in which the commodity is totalized, there is an underlying tension between ecological considerations and the imperatives of value as the form of wealth and social mediation. It implies further that any attempt to respond fundamentally, within the framework of capitalist society, to growing environmental destruction by restraining this society’s mode of expansion would probably be ineffective on a long-term basis — not only because of the interests of the capitalists or state managers, but because failure to expand surplus value would indeed result in severe economic difficulties with great social costs. In Marx’s analysis, the necessary accumulation of capital and the creation of capitalist society’s wealth are intrinsically related. Moreover [...] because labor is determined as a necessary means of individual reproduction in capitalist society, wage laborers remain dependent on capital’s “growth,” even when the consequences of their labor, ecological and otherwise, are detrimental to themselves and to others. The tension between the exigencies of the commodity form and ecological requirements becomes more severe as productivity increases and, particularly during economic crises and periods of high unemployment, poses a severe dilemma. This dilemma and the tension in which it is rooted are immanent to capitalism: their ultimate resolution will be hindered so long as value remains the determining form of social wealth.48

The dilemma described here manifests itself in a many-faceted form. To give an example: while there is a consensus in environmental contexts that the global spread of the “American way of life” or even only of the western European lifestyle would bring with it environmental catastrophes to a degree that has not yet been seen, development organizations must nonetheless pursue precisely this goal, even if it has now become unrealistic. Or, in the terminology of this essay, the employment of labor power that would be necessary for the continued accumulation of capital, even of only half the globally available labor power, at the level of productivity that has been attained, with the corresponding material output and consumption of resources, would result in the immediate collapse of the earth’s ecosystem.

This dilemma also manifests itself in the weekly walk on eggshells as to what is “ecologically necessary” and what is “economically feasible” — the two are now irreconcilable — in the political treatment of the expected climate catastrophe, which is indeed only one of many environmental problems. Politics cannot emancipate itself from capital, since it depends on successful production of surplus value even for its tax revenue and therefore its own ability to act. It already has to go against its own nature in order to pass even resolutions that remain well below the objective requirements of the problem that is to be solved, and that even then nonetheless are softened within a week under pressure from some or other lobby on behalf of what is “economically feasible.” What remains is pure self-dramatization on the part of “doers” who claim still to have the objectively insoluble problems under control.

Conclusion